Inheritocracy is a Sunday Times Bestseller...

And why you should leave your fortune to your cat....

Welcome to Dr Eliza Filby’s Newsletter.

This community is now nearly 6000 strong and includes many readers who support my work. If you’d like to learn more about me, check out my website. You can also watch/follow me on Instagram.

In this week’s edition:

Would you leave your fortune to your cat?

A Tale of Two very different Millennials from Surrey

Why the gig economy is greying…

A Tale of Two Millennials from Surrey

How millennials talk about the Inheritocracy….

Tom, 34

Tom grew up in Surrey and by his own description had an ‘idyllic childhood with lots of animals in a big old house in the south of England’. His parents were both lawyers, he had a nanny and his schooling was all private. ‘My mum was usually home by 6 p.m. while my dad was in the peak of his career, so very busy. I remember staying awake, knowing his train would get in around 7.30 p.m. and [calculating] he would be home within fifteen mins and come in to whisper goodnight.’

From an early age, Tom was conscious of his advantage and people’s reaction to it. ‘You were made very aware at prep school that you were in a privileged position, but when I went to public school at thirteen, it was different. There was one moment when the school was placed into shutdown because there were raids from comprehensive school kids inciting violence against us. It was the first time I became aware that there are [those] who resented people like me.’

Just like his father, uncle and brother, Tom went to Oxford. ‘If I hadn’t got in, I doubt I would have ever got over it,’ he says, only half joking. He paid £3,000 a year in fees: ‘It was all taken care of by my parents, of course.’ But at Oxford, Tom encountered a class rage he found confusing. He was dismissed as ‘posh’ by the lower-middle-class kids and bunched together with those he considered ‘really posh’, all the aristocrats and global elites. ‘Up until the point I got there, I’d never thought of myself as posh, which sounds ridiculous,’ he tells me. ‘I know I present as posh, but I don’t self-identify as posh. You only need to go back three generations, and you will find working-class grandparents. My life is a product of upward social mobility after the Second World War.’

When he left university, Tom pursued his dream career of becoming an actor, which his parents had been happy to fund, as Tom is willing to admit. ‘I moved into my mother’s central London flat that she got free with her job. I was being completely financed by my parents, either directly by paying fees or indirectly through free accommodation. I was expected to earn money, but it was about earning enough to maintain a bit of respect, nothing substantial.’ But after seven years of trying to carve out a career as an actor, Tom decided to pack it in. Knowing something of the lifestyle and challenges of that profession, I asked Tom how he now looks back on those years.

He doesn’t hold back: ‘I was just so fucking lazy. I justified it at the time, but now I think I should have been doing more. I wish someone had said to me, “You should be earning more money; you have a lot of advantages.” There were lots of contemporaries of mine who were having to earn money to live and I wasn’t. I didn’t have that problem and yet I didn’t take advantage of that properly. I count that as a personal failure.’

When Tom met his future wife, it forced him to assess his financial priorities and privilege. ‘She is the complete opposite to me when it comes to money. Savvy as hell,’ he tells me, beaming with pride. ‘She once showed me this flow chart of her fifteen current accounts with standing orders, which she’d arranged for interest. She didn’t get an ounce of help from her mum and dad at all and managed to save £40k. I really bucked my ideas up when I met her. I married someone from a different class and with a different attitude towards money and it saved me,’ he admits.

When it came to buying a house, Tom’s parents gifted him a lump sum for a deposit, but it turned out not to be enough. ‘My father had set aside £50k for my brother and I for a house, which when he set on that figure was a substantial fee, but when I came to use it, it wasn’t enough to buy in London. We have managed to buy a house, but that is largely down to my wife’s frugality more than anything.’

Now in his mid-thirties and a father of one, Tom struggles with the fact that he will not be able to replicate the upbringing his parents gave him. It’s a situation that he blames himself for: ‘I feel guilty. It bothers me that I won’t be able to give my son the same educational advantage that I had. I can put that down to the fact that I decided to spend my youth trying to become an actor rather than doing something that actually made money.’ But Tom also recognises that the economic circumstances today are also very different from when his parents made those choices: ‘Private school fees have gone through the roof. I’d need to earn more than six figures and that is not happening anytime soon. And oddly that is a comfort. I am now earning well beyond the national standards, but I feel like there is no point trying to compare my life with my parents anymore. I cannot recreate that life, not even a small portion of it. Having a kid at thirty-four is telling in itself. We delayed it because we couldn’t afford it.’

Greg, 31

Greg grew up in a single-parent family without access to the Bank of Mum and Dad. ‘I grew up in Surrey, and my schooling was at a bad state school. While I was there, it failed its Ofsted and the whole leadership was fired. There were a couple of murders. It was tough, I would say the worst end of the state education system,’ he tells me. When Greg was fifteen, his mum sat him down and warned him that there were limits to how much support she could give him.

‘She said that if I wanted financial freedom, I was going to have to work for it. So, I started work at sixteen. I became a sales assistant. And I’ve basically been working since then. I’ve normally had one or two jobs each year, in parallel, too.’

Greg won a place at a prestigious university in London, the first in his family to get a degree. One that he is highly proud of and grateful for. ‘I managed to juggle it by working every Saturday, earning £380 per month, which combined with my means-tested grant and loan meant I could survive. I moved back in with my mum for the third year, and although she didn’t help me with finances, she did provide a roof over my head and some food. I had £28,000 debt when I graduated and had repaid it by the time I was twenty-six.’

Greg entered work on a graduate scheme and started supplementing his income by being a private tutor for rich kids, paid for by their parents. ‘Did you resent them?’ I wondered.

He laughs. ‘I actually went to counselling to get over my anger at other people’s wealth and family support. I’m not joking... I was tutoring all these wealthy kids who literally had everything on a plate and very stable environments. You know, I remember this one person: he lived in a beautiful house and used to have a maid that served us Russian tea and biscuits, and he would have six other tutors that day. All these hard-up millennials coming in selling this guy their knowledge. I found it quite depressing, as here I was scrimping for like £100. I felt like the underclass. I was trying to survive on London wages, which was impossible, so I was propping up my wages with tutoring. I didn’t know how to handle it... The therapist went really deep into my family and my relationship with money. She told me I needed to come to terms with that. I couldn’t help but see the irony that my student would pay me £100 for tutoring and I passed that straight on to the therapist to help me cope with it!’

No longer tutoring, Greg is now in a lucrative job earning £160,000, but he finds that money is affecting his ability to find a partner. He chooses not to disclose his earnings when dating.

‘My last relationship ended in 2022 because of financial reasons. The guy did not have a job and I was supporting him a bit too much.’ ‘You’ve spent your life seeking financial autonomy, you don’t want to be dating someone who is dependent on you. I get it,’ I say. ‘Ummm, well there was this rather funny encounter I had in my twenties,’ he confides. ‘There was a particular guy that was a top executive and worth millions. We got to know each other and then he flew me out to San Francisco and proposed to me. He actually said, “I’ll probably die in twenty years and then you can inherit everything.” He also said, “Just quit your job and I’ll look after you. I can give you $5 million tomorrow and that is you and your mum taken care of.” I mean, it was full-on. I thought about it and said no. In all seriousness, though, it felt like the true test of my grit and it only made me more determined to gain financial freedom for myself.’

If Greg has a financial plan, it is earning enough money to support his mother in her old age, but they are also collectively thinking about how she can help him right now to buy a house: ‘I think when I hit £200k, I’ll be giving Mum a couple of grand a month. She’s leaving her house to me, which is worth £320k, just under the inheritance tax bracket. Yes, we’ve checked. We were looking into her doing an equity release to give me a deposit, but her house is a leasehold not a freehold, so we won’t be able to do that. I saw my grandparents in social care homes, and I would never do that to my mum. I’ll be responsible for her as she gets older. That’s also the reason I want to work hard and earn a lot of money because I want to be able to afford in-house care for my mother. If I can’t afford it, I shall have to move in. My hope is that is at least ten years away, but you never know.’

These interviews are from Inheritocracy - order here

The Reading Room

Would you leave your fortune to your cat? In the U.S., 20% of adults over 50 don’t have children. According to the Wall Street Journal, that means inheritance is changing, and it’s not always going to the expected heirs. Surprise inheritances, or what some call "laughing heirs," can land in the hands of distant cousins, charities, and yes, even pets. Karl Lagerfeld’s cat Choupette reportedly inherited $1.5 million from the fashion legend’s estate. It’s possible that soon this will not seem such an oddity; Choupette may be the first in a line of pet heirs.

When does adulthood begin? The majority of Gen Z believe it begins not at 18, but 27 according to a survey in the US. That is the age when apparently you prioritise responsibilities over fun, and financial independence rather than parental dependence and the pressure to perform certain milestones begins.

One in four millennials keen to have children ‘say finances are putting them off’. This research is yet more evidence that financial obstacles are behind the declining birth rate. We perhaps need to remember that historically families were conceived (literally and figuratively) under far worse economic conditions. So what gives? The more interesting aspect of this survey from the UCL Centre for Longitudinal Studies is the fact that women are more likely to report financial concerns about child rearing than men - 30% versus 15%. The big shift is that in an era where dual incomes are a necessity, women rightly fear the financial handicap of having children more than men. As we know, the gender pay gap is rapidly becoming a pregnancy penalty impacting only women who have children.

Forget the Gen Z gig economy; the truth is that Baby Boomers are now the main generation doing multiple jobs

New research from the US labour market found that Baby Boomers are now the generation most likely to be engaged in polywork, that is more than one job. Startfleet found that 1.3 million people aged between 55-64 worked more than one role concurrently in 2023. While this age group slightly overlaps with Gen X, the majority are Baby Boomers, with Gen Z coming in as the second most likely generation to juggle multiple jobs.

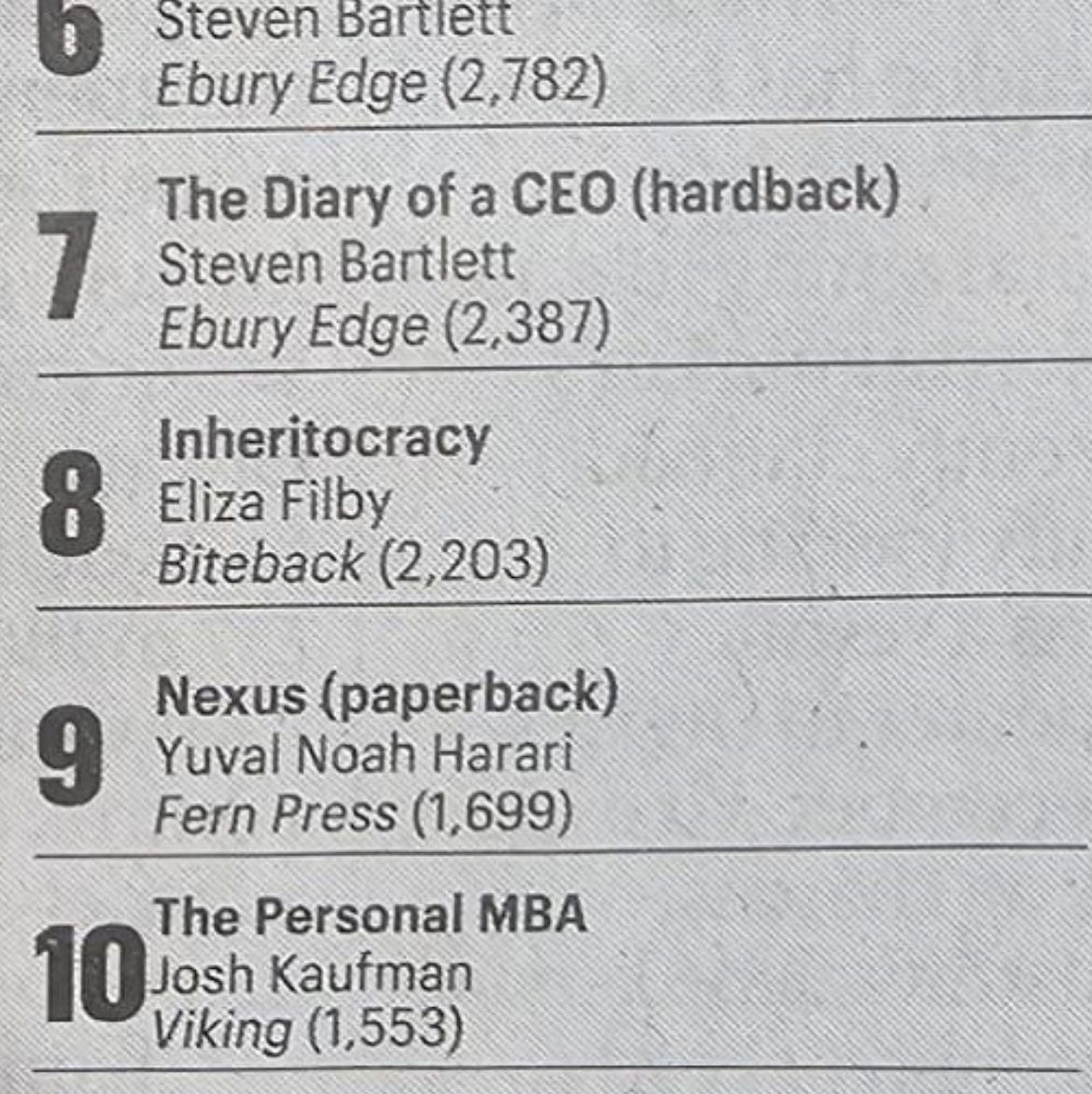

Inheritocracy is a Sunday Times Bestseller...

Whoop! Thank you to all those who bought it. Putting a book out there in this age of information overload is not easy but it is still the best format of long-form content there is.

The Inheritocracy publicity tour continues…. Last week I was interviewed on PoliticsJoe (it has racked up over 144k views and counting) and Intelligence Squared podcast interviewed by the brilliant Roisín Dervish-O'Kane.

The speaking tour continues too; Aviva, Kirkland and Ellis this week, Macfarlanes and Luxottica last week with the brilliant Erin Meyer.

Thanks for reading,

Eliza

Congratulations on the continuing success of the book. Wishing you even greater milestones in the meantime.

"Knowing something of the lifestyle and challenges of that profession, I asked Tom how he now looks back on those years." Did you try acting professionally, yourself, early on, before switching to academia and consulting?